Myanmar has embarked on the gradual liberalisation of the financial services sector. The Central Bank of Myanmar is now allowing foreign banks to hold stakes of up to 35% in domestic banks. Foreign banks are now allowed to open branches in the country to help local businesses gain access to financing, while existing branches of foreign banks will be permitted to operate as subsidiaries. The insurance industry is also opening-up to foreign providers, generating considerable interest from foreign lenders and investors.

This liberalisation will also herald a new era of tougher competition and innovation. Banks need to improve their infrastructure and know-how in order to improve their financial performance. Many are making investments in CRM, core banking systems and mobile delivery platforms to innovate financial products portfolios, create extra revenue streams and enhance profitability.

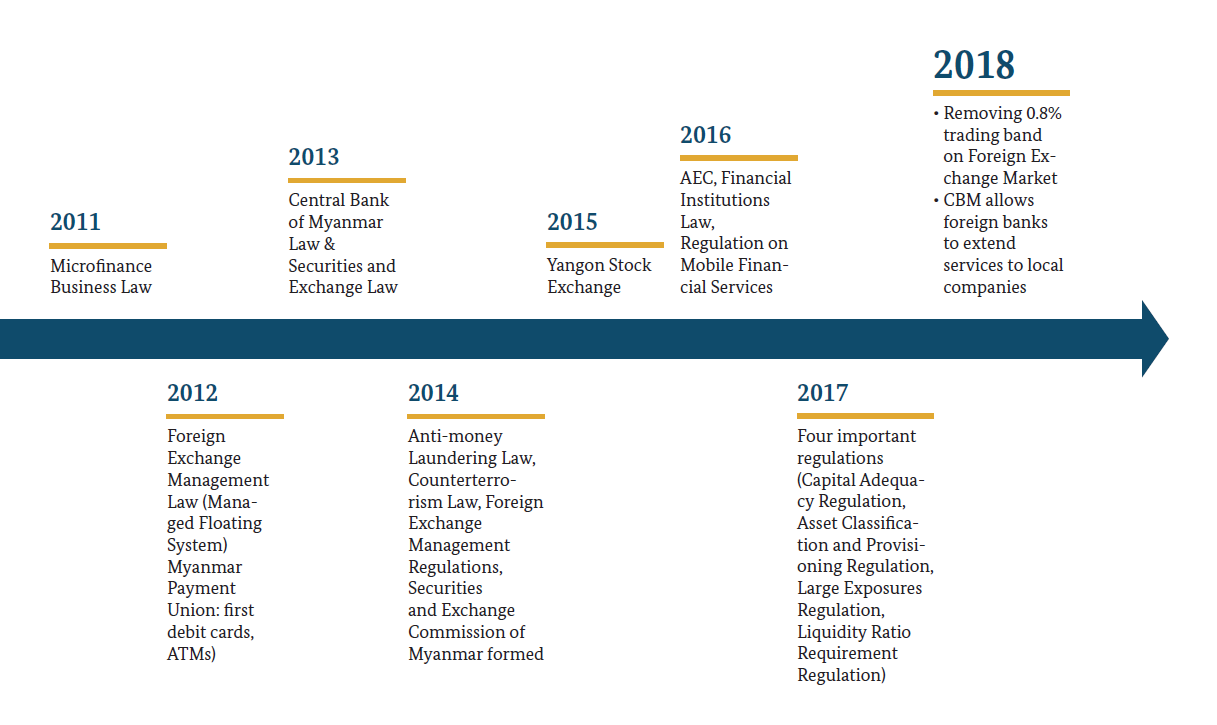

Source: GIZ Myanmar Banking Report 2018

In addition, FinTech has been identified as an effective vehicle to drive true financial inclusion driven by a rapid mobile penetration rate – telcos are expected to cover 90% of the population within the next two years – with data and online access skyrocketing in recent years, paving the way for more innovation and opportunities. For many years, banks and fintechs have competed, but recently both have shifted their focus towards engaging in partnerships - the idea being to leverage on their respective strengths. Myanmar is uniquely positioned to leapfrog brick-and-mortar microfinance and achieve large-scale financial inclusion with the aid of the mobile revolution.

In such a heterogeneous landscape in South East Asia, digital banking is evolving to meet two very different markets. On one hand, ASEAN-5 and Brunei banks are focusing on the millennial population to attract a digital-savvy and young market who don’t do their banking in-branch as previous generations did. On the other hand, digital banking and fintech startups are presenting a realm of possibilities to the unbanked and underbanked population of South East Asia’s developing countries. Meeting these different objectives can be achieved through promoting innovative financial inclusion via digital platforms. Improving and simplifying the banking experience for all.

Click here to watch MITV coverage (in English) of the 2019 edition on National TV 8pm News...

Click here to watch Channel K coverage (in Burmese) of the 2019 edition on Facebook...

The 5th Emerging Asia Banking & FinTech Virtual Summit 2020 will once again deliver first-hand insights and robust opinions from industry experts to help you better strategize your blueprints. Network with key industry players and seize the opportunity to benefit from the only authoritative platform that showcases and dissects real issues, providing you with a practical assessment of emerging opportunities from the region's financial transformation.